Essential Financial Literacy 2024

Feb 5, 2024

Richard Hurt

Feb 5, 2024

5 Comments

Essential Financial Literacy 2024

Essential Financial Literacy for 2024: Empowering Your Economic Future

In the evolving economic landscape of 2024, financial literacy emerges not just as a skill but as an essential tool for navigating the complexities of modern financial systems. As we look ahead, understanding the basics of finance—budgeting, saving, investing, and credit management—becomes crucial for individual empowerment and community resilience. Drawing inspiration from the legacy of economic empowerment exemplified by Black Wall Street, this guide to essential financial literacy in 2024 aims to equip you with the knowledge needed to secure your financial future.

Budgeting: Your Blueprint for Financial Success

Budgeting forms the foundation of effective financial management. It involves tracking your income and expenses to make informed decisions about how best to allocate your resources. In 2024, with the advent of advanced budgeting tools and apps, managing your finances becomes easier yet requires a disciplined approach to ensure you live within your means while saving for the future.

Saving: Building Your Financial Safety Net

The importance of saving cannot be overstated, especially in uncertain economic times. Savings act as a safety net for unforeseen expenses and as a springboard for future investments. Prioritize building an emergency fund that can cover at least three to six months of living expenses, and consider high-yield savings accounts or certificates of deposit (CDs) to maximize your returns.

Investing: Growing Your Wealth

Investing is the key to building long-term wealth. With a variety of investment options available in 2024, from stocks and bonds to mutual funds and real estate, understanding the principles of investing and risk management is vital. Diversify your portfolio to spread risk and consider seeking advice from financial advisors to tailor your investment strategy to your personal goals and risk tolerance.

Credit Management: Protecting and Leveraging Your Financial Reputation

Credit plays a significant role in your financial health, affecting your ability to borrow money, secure housing, and sometimes even obtain employment. Understand your credit score, the factors that impact it, and how to use credit responsibly. Regularly monitor your credit report for accuracy and take steps to improve or maintain a strong credit score.

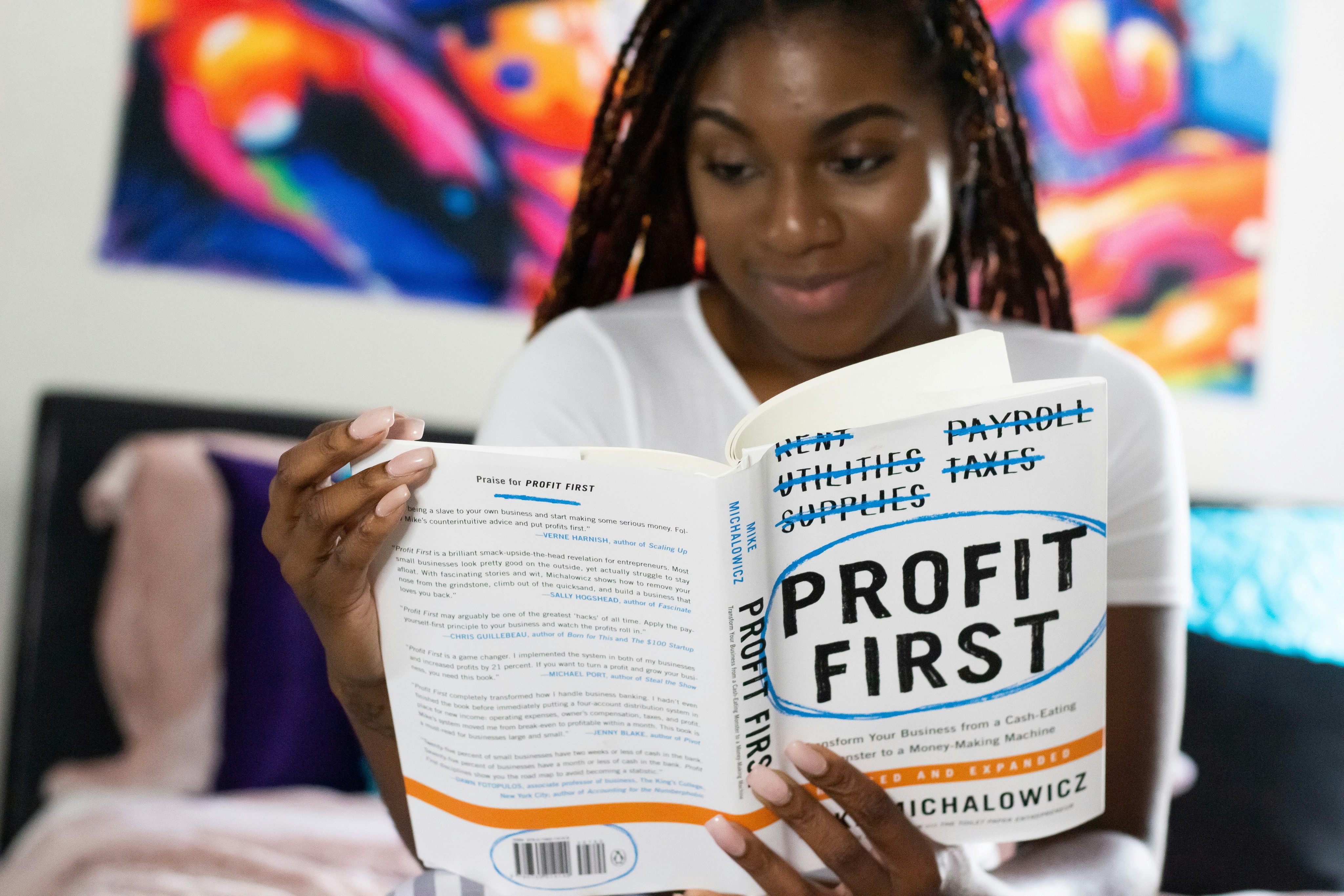

Continuous Education: Staying Informed in a Changing World

Financial literacy is not a one-time achievement but a lifelong journey. The financial landscape is continually evolving, with new products, services, and regulations emerging. Stay informed about financial trends, tax laws, and investment opportunities through reputable sources and ongoing education.

Conclusion

The path to financial empowerment in 2024 and beyond lies in mastering these essential financial literacy skills. Inspired by historical models of economic resilience, individuals and communities alike can leverage this knowledge to build sustainable wealth and achieve financial independence. Remember, financial literacy is not just about personal gain; it's about fostering a culture of empowerment and resilience that can uplift entire communities.

Search here..

Recent Posts

Tags

History

Community

Leadership

Finance

Personal Development

Public Policy

Freedom

Education

Investing

Blog

Read More Articles

Adam Smith

03 Jul, 2023

Adam Smith

03 Jul, 2023

Adam Smith

03 Jul, 2023